Thailand’s customs duties apply to imports with CIF (Cost, Insurance, and Freight) values above 1,500 baht or to restricted goods. The calculation begins with the CIF value—comprising the item’s cost, 1% estimated insurance, and freight—multiplied by the applicable tariff rate.

A 7% VAT is then applied to the total value of CIF plus the import duty. Items shipped via post with CIF not exceeding 1,500 baht are exempt from duties and VAT.

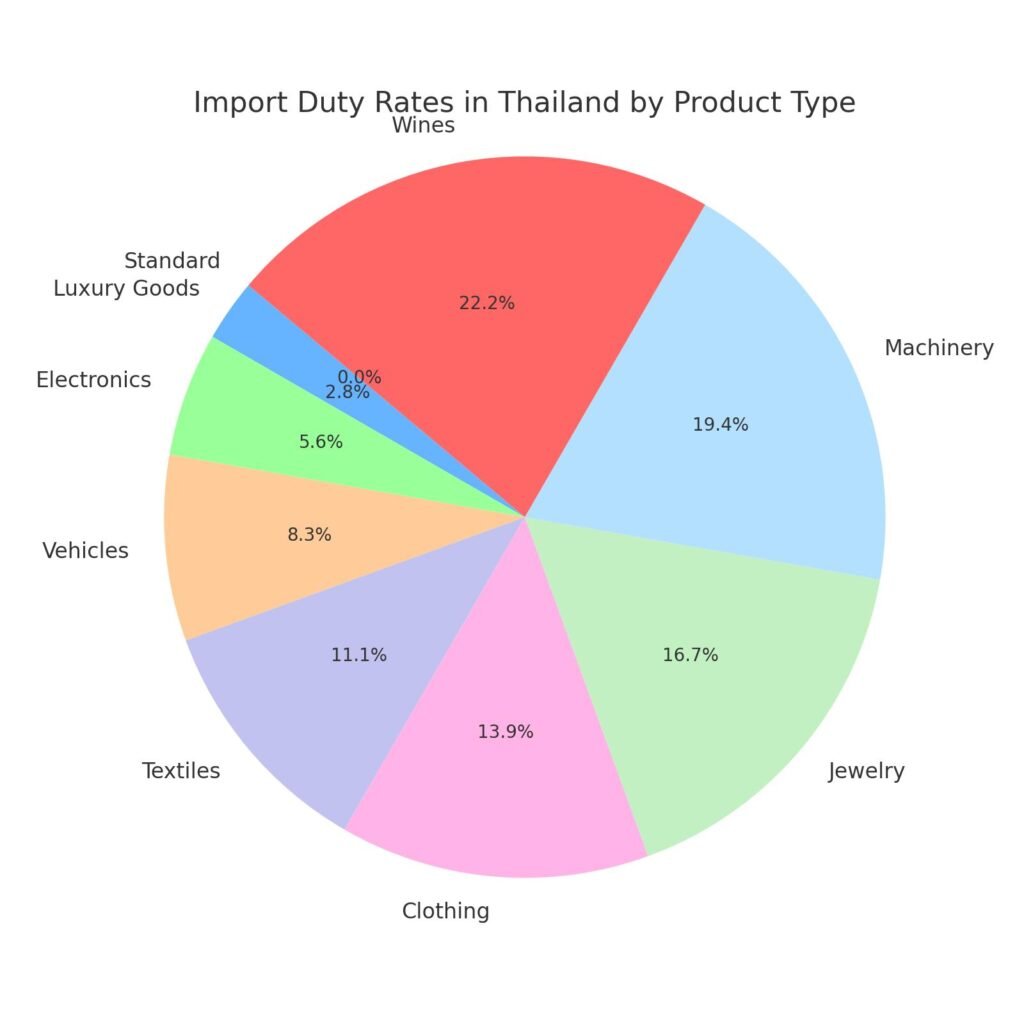

Standard Duty Rates

Import Duty Rates Table

| Category of Goods | Customs Duty Rate | Notes |

|---|---|---|

| Food Products | 5% to 30% | Includes processed foods and packaged beverages |

| Agricultural Products | 0% to 20% | Includes fruits, vegetables, and animal products |

| Automobiles (Passenger Cars) | 30% to 80% | Higher rates for luxury cars |

| Motorcycles | 0% to 30% | Depends on engine size |

| Electronics (phones, laptops, etc.) | 0% to 20% | Consumer electronics |

| Machinery and Equipment | 0% to 10% | Used machinery may have lower rates |

| Textiles and Apparel | 0% to 20% | Higher duties on finished garments |

| Jewelry and Precious Metals | 0% to 10% | Generally lower to encourage trade |

| Tobacco and Cigarettes | 40% to 60% | Discourages imports |

| Alcoholic Beverages (wine, beer, spirits) | 20% to 60% | Beer often at 60%, wine around 54% |

| Petroleum Products | 0% to 5% | Lower due to energy necessity |

| Pharmaceuticals | 0% | Medicines are typically exempt |

| Chemicals | 0% to 10% | Used in various industries |

| Furniture and Household Items | 0% to 20% | Varies by type and material |

| Cosmetics and Personal Care | 5% to 20% | Based on ingredients and classification |

| Books and Educational Materials | 0% | Typically exempt to encourage learning |

| Computer Parts | 0% to 10% | Low duties on tech components |

3. Detailed Explanation

3.1 Calculation Method

- CIF Value = Cost + Insurance (1% of cost) + Freight

- Import Duty = CIF × Tariff rate

- VAT = (CIF + Duty) × 7%

- Total Payable Tax = Import Duty + VAT

Example: Running shoes may attract a 30% duty, while wristwatches might carry a 5% rate.

3.2 HS Code Classification

All goods must be correctly classified using Harmonized System (HS) codes to determine the correct duty rate. Misclassification can lead to fines or delays. You can find more details about hs code here.

3.3 Duty Range

Thailand’s import duties range from 0% to 80%. Higher rates usually apply to luxury and consumer-protective goods, while essential and industrial goods often carry lower or zero duties.

3.4 Free Trade Agreements & Exemptions

Thailand has several FTAs that allow lower or zero tariffs for qualifying goods. Businesses operating in special economic zones or under BOI promotion may also benefit from exemptions.

3.5 Exemption Threshold

Goods with a CIF value of 1,500 baht or less, especially when shipped via post or express courier, are exempt from import duties and VAT.

Calculate your import duty with Thailand import duty calculator.

Conclusion

Importing into Thailand involves navigating a complex but structured system of customs duties. With rates ranging from 0% to 80%, businesses and individuals should ensure accurate classification, calculate CIF properly, and check for any FTA benefits or exemptions. Leveraging online tools and understanding duty thresholds can greatly improve cost efficiency and compliance when importing goods into Thailand.