Navigating customs charges can be tricky when sending goods from the UK to Ireland. Understanding the rules and regulations can save you money and ensure your packages arrive smoothly. Here’s a detailed guide on how to avoid those pesky customs fees.

1. What Are Customs Charges?

Customs charges, also known as duties and taxes, are fees imposed by governments on goods imported from other countries. When shipping from the UK to Ireland, these charges can vary based on the value and type of goods. In the wake of Brexit, customs procedures have changed, meaning it’s essential to stay informed about the latest regulations.

How to Avoid Customs Charges When Shipping from the UK to Ireland

When shipping items from the UK to Ireland, understanding customs charges is crucial to avoid unexpected fees. Customs charges, or import duties, are applied based on the value and type of goods being shipped. To determine if these charges apply, you can use the Ireland import duty calculator, which helps you estimate potential fees based on the value of your shipment and the nature of the goods. Keeping your package value below the €150 de minimis threshold can help you avoid these charges altogether.

To minimize customs charges, ensure proper documentation accompanies your shipment, including a customs declaration form and invoices. Consider shipping methods that offer customs brokerage services, as they can facilitate smoother clearance. Additionally, breaking larger shipments into smaller parcels and purchasing from UK-based sellers familiar with customs regulations can further mitigate costs. Staying informed about trade agreements and the specifics of customs procedures will streamline the process and enhance your shipping experience.

2. How Can You Determine if Customs Charges Apply?

To ascertain whether customs charges will apply, consider the following factors:

- Value of Goods: If the value of your package exceeds a certain threshold (usually around €150 for gifts), it is likely to incur customs charges.

- Type of Goods: Some items are subject to higher tariffs than others. Familiarize yourself with the customs tariff codes related to your goods.

- Origin of Goods: Goods manufactured outside the EU may attract additional tariffs. Be sure to check the country of origin.

3. What is the De Minimis Threshold?

The de minimis threshold refers to the value limit below which goods can enter a country without incurring customs duties. In Ireland, this threshold is currently set at €150 for most goods. If your package’s value is below this limit, you can avoid customs charges altogether.

4. How Can You Package Your Items?

When sending items, how you package them can influence whether customs charges apply:

- Break Down Large Shipments: If possible, break larger shipments into smaller packages, each valued below the €150 threshold.

- Gift Status: If you’re sending gifts, ensure they are appropriately labeled. However, be cautious—overly inflated values can trigger customs inspections and charges.

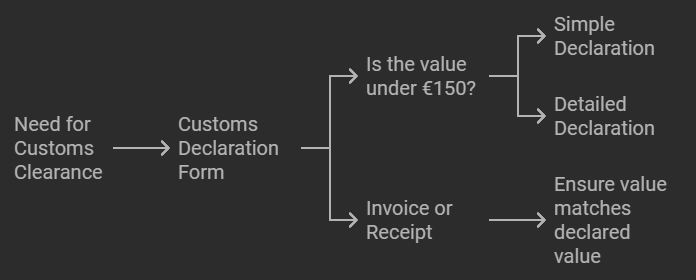

5. What Documentation Do You Need?

Proper documentation is crucial for smooth customs clearance. Key documents include:

- Customs Declaration Form: This form details the contents, value, and purpose of the shipment. For items valued under €150, a simple declaration might suffice.

- Invoice or Receipt: Including an invoice or receipt can substantiate the value of the goods. Ensure it matches the declared value on your customs form.

6. How Can You Use Appropriate Shipping Methods?

Choosing the right shipping method can minimize customs charges:

- Select Reliable Carriers: Use reputable carriers that offer customs brokerage services. They can help ensure your packages comply with regulations and minimize delays.

- Consider Local Carriers: Sometimes, local carriers have arrangements that make customs handling smoother, potentially reducing or eliminating fees.

7. What Are the Rules for Online Purchases?

If you’re purchasing goods online, consider these tips to avoid customs charges:

- Shop from UK-Based Sellers: Buying from UK sellers who have a clear understanding of customs regulations can help mitigate unexpected fees.

- Look for Inclusive Pricing: Some retailers offer prices that include shipping and potential customs fees. This can help you avoid surprises at delivery.

8. How Can You Leverage Trade Agreements?

Since Brexit, the UK and the EU have established new trade agreements. Understanding these agreements can help you navigate customs:

- Check for Tariff-Free Trade: Certain goods may qualify for tariff-free access under specific conditions. Familiarize yourself with the rules that apply to your items.

- Origin Rules: Ensure that your goods meet the criteria for origin rules outlined in the trade agreements, which could exempt them from duties.

9. What Are Common Mistakes to Avoid?

Avoid these common pitfalls that could lead to customs charges:

- Misdeclaring Value: Always declare the true value of your goods. Under-declaring can lead to penalties and increased scrutiny.

- Ignoring Customs Regulations: Failing to comply with customs rules can result in delays, additional charges, or even confiscation of goods.

10. What to Do If You Do Encounter Customs Charges?

If you do find yourself facing customs charges, here are steps you can take:

- Request a Breakdown of Charges: If you receive a customs bill, ask for a detailed explanation of the charges. This can help you understand if they are justified.

- Appeal if Necessary: If you believe the charges are incorrect, you may have the option to appeal through the customs authority. Gather all necessary documentation to support your case.

FAQs: Do you have to pay customs from the UK to Ireland?

Yes, you may have to pay customs charges when shipping items from the UK to Ireland, depending on the value and type of goods. If the value of your shipment exceeds the de minimis threshold of €150, import duties and VAT may apply.

Do you go through customs between the UK and Ireland?

Yes, there are customs checks for goods moving between the UK and Ireland. Since Brexit, the UK is no longer part of the EU customs union, which means that customs declarations and checks are now required for goods entering Ireland from the UK.

How do I know if I have to pay customs in Ireland?

To determine if you need to pay customs charges, consider the value of your shipment and the type of goods. If the total value exceeds €150, you will likely incur customs duties. You can also use the Ireland import duty calculator to estimate potential fees based on the specifics of your shipment.

Do I need a customs declaration from the UK to Ireland?

Yes, you will need to complete a customs declaration for goods sent from the UK to Ireland. This includes detailing the contents, value, and purpose of the shipment. Proper documentation is crucial for smooth customs clearance.

How much is duty-free from the UK to Ireland?

Goods valued under €150 are typically duty-free, meaning you won’t incur customs charges on these items. However, certain goods may have specific regulations or exceptions, so it’s essential to check the details based on what you are shipping.

Do you always have to pay import duties in Ireland?

Not always. You may be exempt from paying import duties if the item is a personal gift worth less than €45, or if the seller uses DDP or IOSS to cover taxes upfront. Full details are available in this guide: Do you have to pay import duties in Ireland?

What happens if I refuse to pay customs charges?

If you refuse to pay the customs charges, your parcel may be returned to the sender or even discarded by the courier. Each courier (e.g., An Post, DHL) has its own policy. For the official government rules, see Revenue’s customs overview.

How can I confirm customs limits before shopping online?

To avoid surprises, check the most recent limits and VAT rules for non-EU purchases using Revenue’s buying online guide. You can also estimate costs with the Ireland Import Duty Calculator.

Conclusion

Avoiding customs charges when shipping from the UK to Ireland is manageable with the right knowledge and preparation.

By understanding customs regulations, properly documenting your shipments, and selecting appropriate carriers, you can significantly reduce or even eliminate potential fees.

Staying informed about the latest changes in trade agreements and customs procedures will also aid in making the shipping process as smooth as possible.