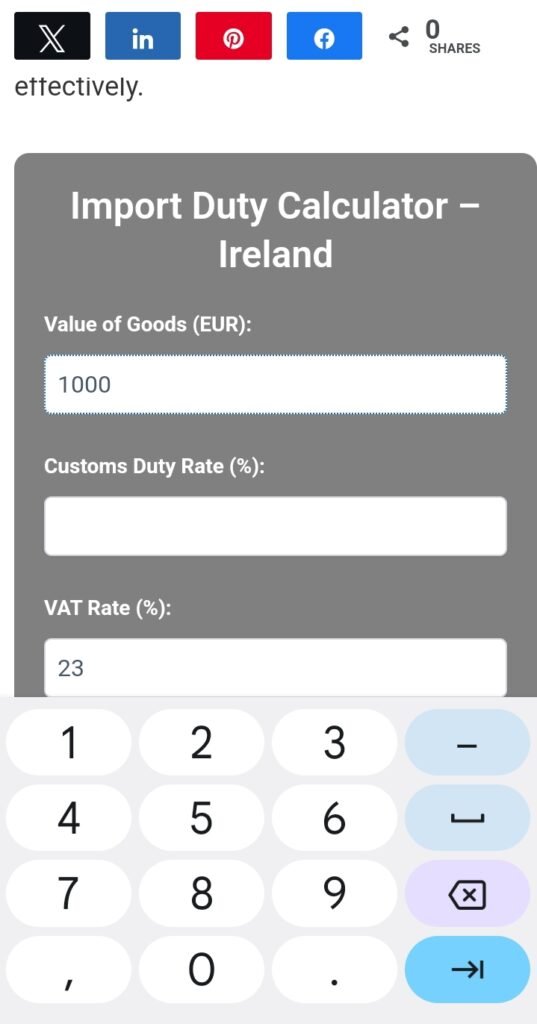

The Import Duty Calculator for Ireland is designed to help you estimate the additional costs associated with importing goods into Ireland.

By entering the value of the goods, the applicable customs duty rate in Ireland, and any additional costs like insurance or freight, you can quickly calculate the import duty and VAT you need to pay.

This tool is particularly useful for businesses and individuals looking to understand the full cost of their imported items, ensuring transparency and helping you plan your expenses effectively.

Service: Get a custom import duty calculations with report. Fill the form here with your import details.

Import Duty Calculator – Ireland

Disclaimer:

The Import Duty Calculator for Ireland provides estimated costs for importing goods but should not be considered definitive. Actual duties and taxes may vary based on specific circumstances and are subject to change by Irish customs authorities.

Users are advised to verify the rates and calculations with official sources or consult with a customs professional before making any financial decisions. The tool is provided for informational purposes only, and no liability is assumed for any discrepancies in the calculations.

You can find more information here.

How to use Ireland Import Duty Calculator

To use the Ireland Import Duty Calculator, follow these steps:

Enter the Value of Goods:

Input the total cost of your goods in euros (EUR).

Select the Import Duty Rate:

Choose the appropriate duty rate based on the type of goods you’re importing.

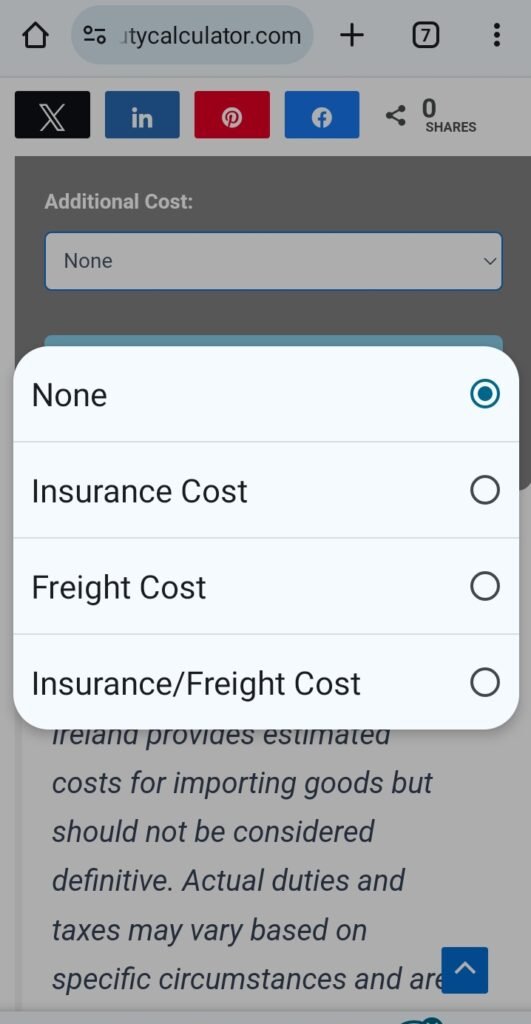

Add Additional Costs:

If applicable, select and enter any additional costs such as insurance or freight charges.

Calculate:

Click the “Calculate” button to view the estimated import duty, VAT, and total cost of importing the goods into Ireland.

How is Import Duty Calculated in Ireland?

Import duty in Ireland is calculated based on the value of the goods, the type of product, and its country of origin. The value includes the cost of the goods, shipping costs, and insurance. The product type is identified by the Harmonized System (HS) code, which determines the applicable duty rate. If the goods are subject to preferential tariffs under trade agreements, reduced rates may apply.

Do You Have to Pay Import Duties in Ireland?

Yes, you generally have to pay import duties when bringing goods from non-EU countries into Ireland. Goods imported from within the EU are not subject to import duties due to Ireland being part of the EU Customs Union.

How Do I Import Goods to Ireland?

To import goods into Ireland:

- Obtain an EORI Number: You need an Economic Operators Registration and Identification (EORI) number for customs declarations.

- Classify Your Goods: Identify the correct HS code for your goods to determine tariffs.

- Complete Customs Declarations: Submit customs declarations electronically using the Automated Import System (AIS).

- Pay Duties and Taxes: Pay any applicable import duties, VAT, and other taxes.

- Comply with Regulations: Ensure compliance with any specific regulations or restrictions related to your goods.

What is the Import Allowance in Ireland?

The import allowance in Ireland refers to the value or quantity of goods that can be brought into the country without incurring customs duties or taxes. For personal imports from outside the EU, the allowance is generally €430 for air and sea travelers and €300 for other travelers. However, this applies to goods brought in as part of personal luggage, not commercial imports.

What is the Customs Duty on a Parcel to Ireland?

The customs duty on a parcel to Ireland depends on the value, type, and origin of the goods. For parcels valued under €150, there’s typically no customs duty, but VAT and handling fees may still apply. For parcels above €150, the duty rate varies according to the product’s HS code.

Can You Claim Back Import Duty in Ireland?

Yes, you can claim back import duty in Ireland under certain circumstances, such as if the goods are re-exported or if an incorrect amount was paid due to an error. This process typically involves submitting a claim to Irish Revenue, providing proof of the original import and subsequent export or correction.

How Much is VAT in Ireland?

The standard VAT rate in Ireland is 23%. However, reduced rates of 13.5%, 9%, and 4.8% apply to certain goods and services, including food, hospitality, and certain printed materials.

What are 5 Imports of Ireland?

Five major imports of Ireland include:

- Machinery and Equipment: Including computers and telecommunications equipment.

- Chemicals and Pharmaceuticals: Used in various industries, including healthcare.

- Vehicles and Transport Equipment: Including cars and aircraft.

- Mineral Fuels: Such as oil and gas.

- Foodstuffs: Including fruits, vegetables, and processed foods.

These imports are vital to Ireland’s economy, supporting various sectors from manufacturing to consumer goods.

Tools:

- Canada Import Duty Calculator

- Uk Import Duty Calculator

- US Customs Duty Calculator

- Import Duty Calculator Pakistan

- Iceland Import Tax Calculator

- Indian customs import duty calculator

- Ireland Import Duty Calculator

- Import Duty Calculator for Australia

- Kenya Electronics Import Duty Calculator

- Jamaica Import Duty Calculator

- Kenya import duty calculator

- Nigeria Car custom duty calculator

- Nigeria custom duty calculator

- South Africa Import Duty Calculator

- Tanzania Import Duty Calculator

- Car import duty calculator Bangladesh

- Bangladesh Import Duty Calculator

- Pakistan Car Import Duty Calculator

Browse Import Duty Rates By Country:

- UK Customs Duty Rates

- US Customs Duty Rates

- Canada Customs Duty Rates

- Jamaica Custom Duty Rates

- Ireland Import Tariff Rates

- Import Duty Rates in Bangladesh

- Tanzania Duty Rates

- India Duty Rates

- Nigeria Car Custom Duty Rates

- Kenya Customs Duty Rates

- Japan Customs Duty Rates

- Morocco Import Duty Rates

- Australia Import Duty Rates

- Kenya Custom Duty Rates

Further Reading

- Tol, Richard & Leahy, Eimear & Lyons, Sean. (2011). The Distributional Effects of Value Added Tax in Ireland. The Economic and Social Review. 42. 213-235. Retrieved from here

- Leahy, E., Lyons, S., and Tol, R. (2010). The Distributional Effects of Value Added Tax in Ireland, ESRI Working Paper 366, Dublin: ESRI, Retrieved from here

- The Distributional Effects of Value Added Tax in Ireland. Retrieved from here