How to Use the Morocco Import Duty Calculator: This Morocco import duty calculator helps you estimate the import duty and VAT you’ll need to pay when importing products into Morocco. Here’s a step-by-step guide:

1. Enter Product Value and Quantity:

- Start by entering the value of your first product in Moroccan Dirham (MAD) and the quantity.

- If you have multiple products, click “Add Another Product” to add new fields. You can add as many products as needed by clicking the button each time.

2. Enter Duty Rate:

- Enter the Duty Rate as a percentage (e.g., 10 for 10%).

For more details about Moroccan duty rates, check here.

3. Enter VAT Rate:

- Enter the VAT Rate as a percentage (e.g., 20 for 20%).

4. Select Additional Costs:

- Choose any additional import-related costs, if applicable:

- None: No additional costs will be added.

- Insurance: Adds an input for the insurance cost.

- Freight: Adds an input for the freight cost.

- Insurance/Freight: Adds inputs for both insurance and freight costs.

5. Calculate:

- Click “Calculate” to see the total estimated cost.

Results Interpretation

After calculating, the calculator will display:

- Total Amount: The combined product value(s) plus any additional costs.

- Duty You Need to Pay: The calculated duty amount based on the entered duty rate.

- VAT You Need to Pay: The calculated VAT amount based on the total amount (products + duty).

- Grand Total: The final total after adding the product values, duty, VAT, and any additional costs.

This breakdown helps you understand the full cost of importing products into Morocco.

Service: Get a custom import duty calculations with report. Fill the form here with your import details.

Morocco Import Duty Calculator

Disclaimer: This Morocco import duty calculator provides estimated import duty and VAT amounts based on the values and rates you enter. Actual costs may vary, so please consult with a customs professional or relevant authority for precise charges and rates.

For information, check Morocco Trade Authority here. You can also find more information from here and here.

What is the Customs Value in Morocco?

The customs value in Morocco is the basis for calculating customs duties, import VAT, and other fees on imported goods. It usually includes the cost of the goods, insurance, and freight (CIF value) up to the Moroccan port or border.

The Moroccan Customs and Excise Administration (ADII) assesses this value based on the transaction value method, which means it considers the actual price paid or payable for the goods.

In cases where the transaction value can’t be determined, Moroccan customs may use alternative methods, such as the customs value of similar goods, deductive value, or computed value, to assess the proper value.

What is Import VAT in Morocco?

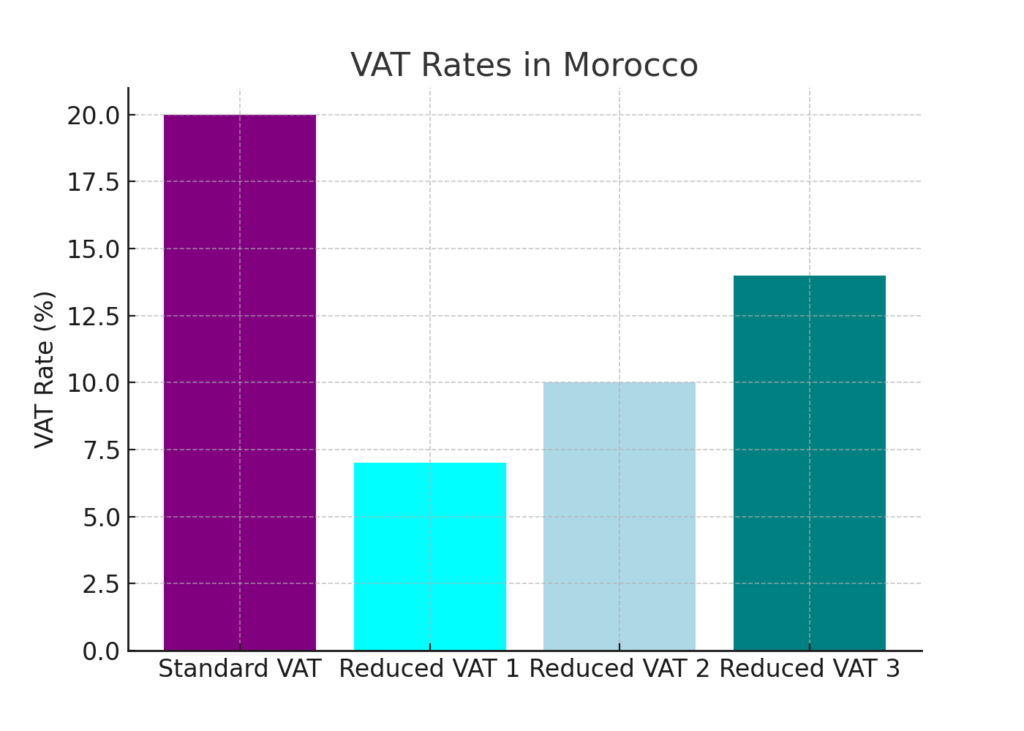

Morocco applies a standard import VAT rate of 20% on goods imported into the country. However, this rate may vary based on the type of goods.

Some essential goods, like certain foodstuffs, medical products, and agricultural supplies, are subject to reduced rates or may be exempted entirely from VAT.

Import VAT is calculated on the CIF value plus any applicable customs duties. This means that the combined value of the goods, insurance, freight, and customs duty forms the base on which import VAT is applied. Import VAT aims to equalize the tax burden between imported and locally produced goods in Morocco.

How Much is Import Duty in Morocco?

The import duty in Morocco varies depending on the type of goods being imported, ranging generally from 2.5% to 50%.

The duty rate is influenced by several factors, including the nature of the goods, origin, and any applicable trade agreements.

For example, certain goods imported from countries that have trade agreements with Morocco may benefit from preferential duty rates or even exemption.

To determine the exact rate for a specific item, importers can consult the Moroccan Customs tariff schedules or seek assistance from the customs authority. Common consumer products tend to have higher duty rates, while essential or raw goods may face lower tariffs.

How Do You Calculate Import Duty Rate?

To calculate the import duty rate in Morocco, follow these steps:

- Determine the CIF Value: This is the cost of the goods, including insurance and freight charges up to Morocco.

- Identify the Duty Rate for the Product: Use Morocco’s customs tariff schedules or consult Moroccan Customs to find the duty rate applicable to your product.

- Apply the Duty Rate to the CIF Value: Multiply the CIF value by the duty rate to get the import duty amount.

For instance, if you’re importing an item with a CIF value of $1,000 and a duty rate of 20%, the import duty would be $200. Remember, other fees such as VAT and administrative charges might be added later.

How to Import Goods to Morocco?

To import goods to Morocco, an importer must complete a series of steps to comply with Moroccan customs regulations:

- Register as an Importer: First, you need to register with Moroccan authorities and acquire any required licenses specific to your type of goods.

- Prepare Necessary Documentation: Key documents include the commercial invoice, packing list, bill of lading or airway bill, certificate of origin, and insurance documents. Moroccan customs may also require other specific certifications depending on the nature of the goods.

- Submit a Declaration to Customs: The importer or a customs broker submits a detailed declaration form, including the CIF value, nature of goods, country of origin, and the applicable tariff code.

- Pay Import Duties and Taxes: Customs will calculate the amount of duty, VAT, and any additional fees based on the CIF value and duty rate. Once payment is made, the goods can be cleared for import.

- Undergo Customs Inspection: Moroccan customs may inspect shipments to verify compliance with local regulations. This inspection is usually for risk assessment, quality, and value confirmation.

Once all steps are completed and all duties and taxes are paid, the goods are released for entry into Morocco.

Tools:

- Canada Import Duty Calculator

- Uk Import Duty Calculator

- US Customs Duty Calculator

- Import Duty Calculator Pakistan

- Iceland Import Tax Calculator

- Indian customs import duty calculator

- Ireland Import Duty Calculator

- Import Duty Calculator for Australia

- Kenya Electronics Import Duty Calculator

- Jamaica Import Duty Calculator

- Kenya import duty calculator

- Nigeria Car custom duty calculator

- Nigeria custom duty calculator

- South Africa Import Duty Calculator

- Tanzania Import Duty Calculator

- Car import duty calculator Bangladesh

- Bangladesh Import Duty Calculator

- Pakistan Car Import Duty Calculator

Browse Import Duty Rates By Country:

- UK Customs Duty Rates

- US Customs Duty Rates

- Canada Customs Duty Rates

- Jamaica Custom Duty Rates

- Ireland Import Tariff Rates

- Import Duty Rates in Bangladesh

- Tanzania Duty Rates

- India Duty Rates

- Nigeria Car Custom Duty Rates

- Kenya Customs Duty Rates

- Japan Customs Duty Rates

- Morocco Import Duty Rates

- Australia Import Duty Rates

- Kenya Custom Duty Rates

FAQs: Is Morocco a Duty-Free Country?

No, Morocco is not a duty-free country. Goods imported into Morocco are subject to customs duties, import VAT, and other charges depending on the type and value of the goods.

However, Morocco does offer special economic zones and free trade agreements with several countries, which may allow for reduced or zero-duty rates on specific products.

For example, Morocco has trade agreements with the European Union, the United States, and other African countries that allow duty-free or reduced-duty access for certain products.

What Are Two Major Imports in Morocco?

Morocco’s two major imports are crude oil and automobile components.

- Crude Oil: Morocco heavily relies on imported crude oil and petroleum products to meet its energy needs, as it has limited domestic oil production.

- Automobile Components: As a growing player in the automotive manufacturing sector, Morocco imports significant amounts of car parts and components, especially for assembly in its automotive hubs.

These imports are crucial to Morocco’s economy, supporting its transportation and manufacturing industries.

How Does VAT Work in Morocco?

In Morocco, VAT (Value-Added Tax) is applied to most goods and services, including imports. The standard VAT rate is 20%, although certain products, such as basic foodstuffs, medicines, and agricultural goods, may have reduced rates or exemptions.

For imports, VAT is calculated on the CIF value of the goods, which includes cost, insurance, and freight, plus any customs duties. This means that import VAT is assessed on the total landed cost of the goods, effectively equalizing the tax burden for both imported and locally produced goods.

Import VAT is paid during the customs clearance process and is required to release the goods into Morocco.

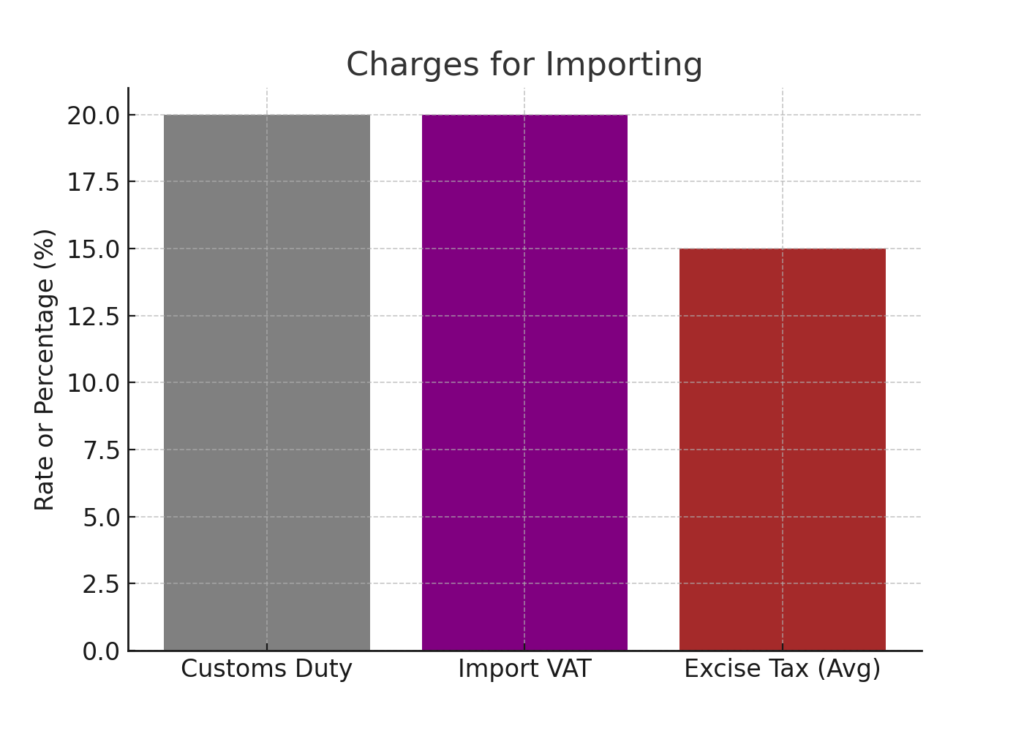

What Are the Charges for Importing?

When importing goods to Morocco, various charges may apply, including:

- Customs Duty: Based on the type and value of the goods, with rates ranging from 2.5% to 50%.

- Import VAT: Generally 20% but can vary by product type.

- Customs Processing Fees: These fees cover administrative costs for processing and clearing goods through customs.

- Excise Taxes: Applied on certain products like tobacco, alcohol, and luxury goods, depending on their classification.

- Additional Levies: Certain items may be subject to environmental or social charges, depending on their nature and classification.

These charges are calculated based on the CIF value, making it essential for importers to accurately determine the total import costs.

What is the Tariff Rate in Morocco?

The tariff rate in Morocco varies depending on the type of goods being imported. Standard tariff rates range from 2.5% to 50% based on the product category, with higher rates typically applied to luxury items and non-essential goods, while raw materials and essential goods may face lower rates or even exemptions.

Morocco’s tariff rates are also influenced by trade agreements. Goods from countries with preferential trade deals may qualify for lower tariffs or duty-free entry, especially for certain goods from the European Union, the United States, and other African nations.