The US Customs Duty Calculator is designed to simplify import cost calculations for individuals and businesses. This tool provides a clear view of total import taxes by factoring in product value, quantity, duty rate, and VAT, along with additional costs like insurance and shipping.

Ready to estimate your import costs? Find US rates here and get started!

Service: Get a custom import duty calculations with report. Fill the form here with your import details.

US Customs Duty Calculator

Similar Calculators:

- Canada Import Duty Calculator

- Uk Import Duty Calculator

- US Customs Duty Calculator

- Import Duty Calculator Pakistan

- Iceland Import Tax Calculator

- Indian customs import duty calculator

- Ireland Import Duty Calculator

- Import Duty Calculator for Australia

- Kenya Electronics Import Duty Calculator

- Jamaica Import Duty Calculator

- Kenya import duty calculator

- Nigeria Car custom duty calculator

- Nigeria custom duty calculator

- South Africa Import Duty Calculator

- Tanzania Import Duty Calculator

- Car import duty calculator Bangladesh

- Bangladesh Import Duty Calculator

- Pakistan Car Import Duty Calculator

Browse Import Duty Rates By Country:

- UK Customs Duty Rates

- US Customs Duty Rates

- Canada Customs Duty Rates

- Jamaica Custom Duty Rates

- Ireland Import Tariff Rates

- Import Duty Rates in Bangladesh

- Tanzania Duty Rates

- India Duty Rates

- Nigeria Car Custom Duty Rates

- Kenya Customs Duty Rates

- Japan Customs Duty Rates

- Morocco Import Duty Rates

- Australia Import Duty Rates

- Kenya Custom Duty Rates

Table of Contents

US Customs Duty Calculator Instructions

Enter Value: Enter the value of the first item. This is usually the price you paid for it.

Enter Quantity: Enter the quantity. If you're importing multiple items, this will calculate the cost per unit.

Enter Duty Rate: Enter the duty rate for this item. This is usually a percentage.

Add More: (If Needed) If you have more products with different duty rates, click Add Another Product. This will allow you to enter the value, quantity, and duty rate for each additional product. Repeat this for as many products as you need.

Enter VAT: Rate Enter the VAT rate for your imports. This will be the same for all products in the calculation.

Choose Additional Costs Select one of the following:

Free on Board (FOB) – If your product has no extra shipping or insurance fees, select this. Insurance and Shipping Costs – If applicable, select this and enter your insurance and shipping costs in the fields provided. Calculate Once you’ve entered all the required information, click Calculate. The tool will process your inputs and show:

- Duty rate for each item

- VAT rate for the total order

- Total tax to pay

View Results: Check the output, which shows a breakdown of import duty and VAT for each item and the total tax due.

FAQs about the U.S. Customs Duty Calculator

What is a U.S. Customs Duty Calculator?

A U.S. Customs Duty Calculator is an online tool to estimate the import taxes, duties, and fees for goods entering the U.S. In 2022, U.S. Customs collected over $96 billion in duties, highlighting its significant role in imports.

How is customs duty calculated?

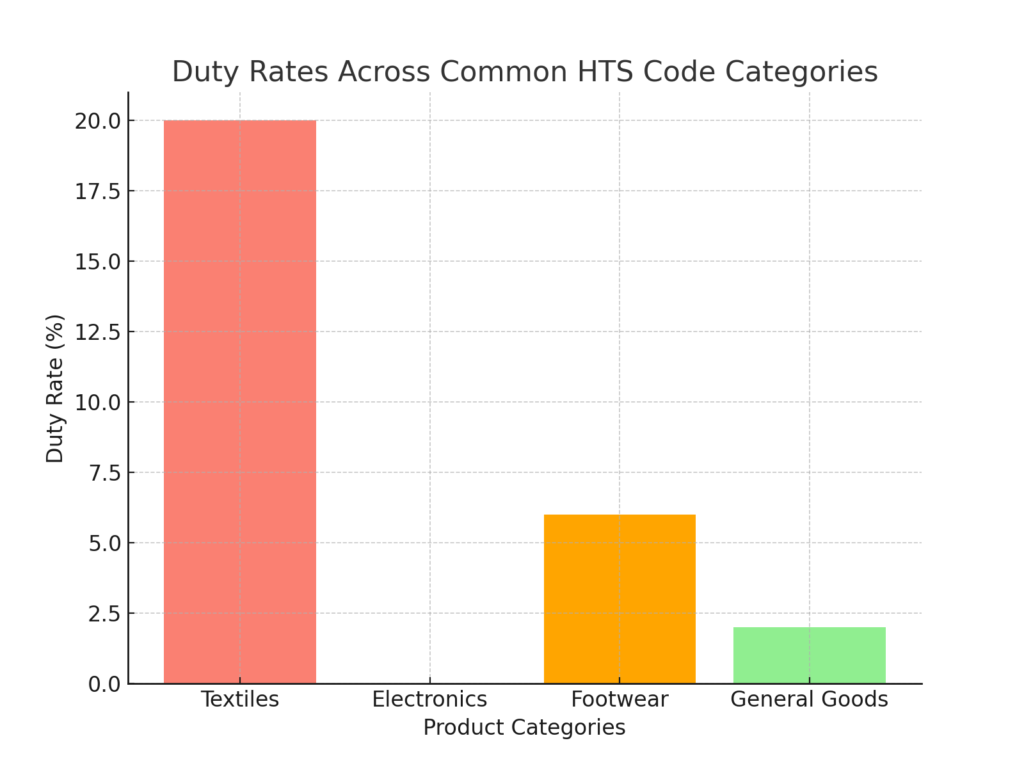

Customs duty is generally calculated based on the item’s “dutiable value”—usually the cost of goods plus insurance and freight (CIF). The average duty rate for imported goods is 2%, though some categories like apparel can go up to 32%.

What information do I need to use the calculator?

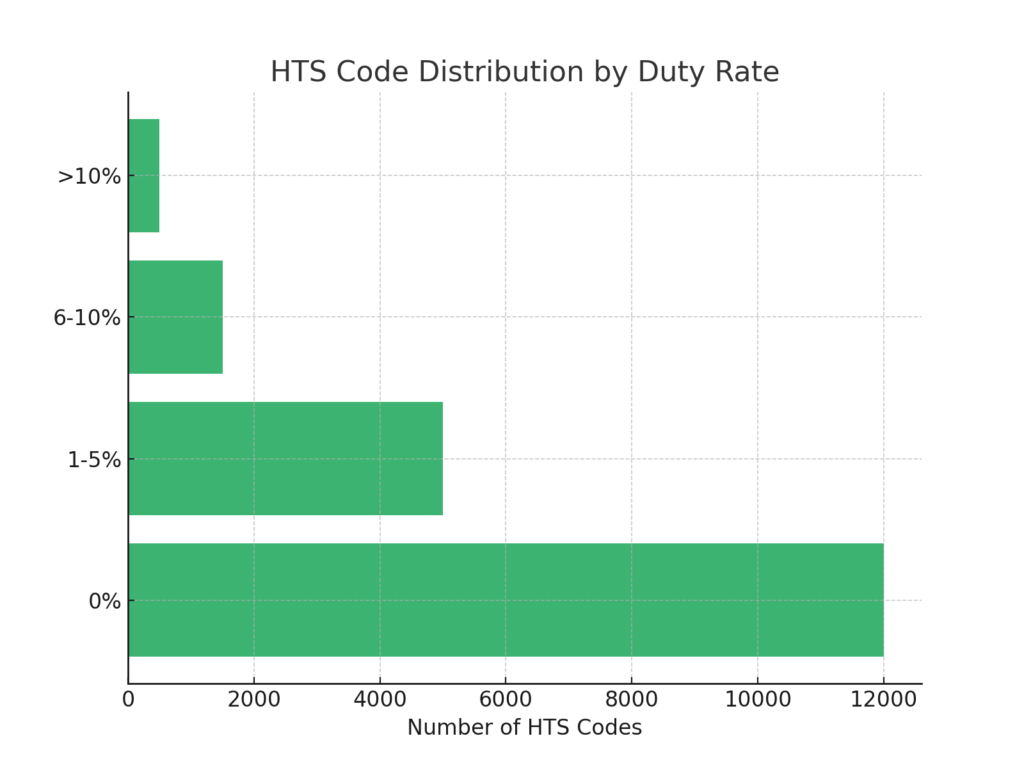

You’ll need details such as the product value, origin country, and product type (classified by HTS codes). For example, using the correct HTS code can change duty rates from 0% for certain electronics to 20% for textiles.

Are there any items exempt from U.S. customs duty?

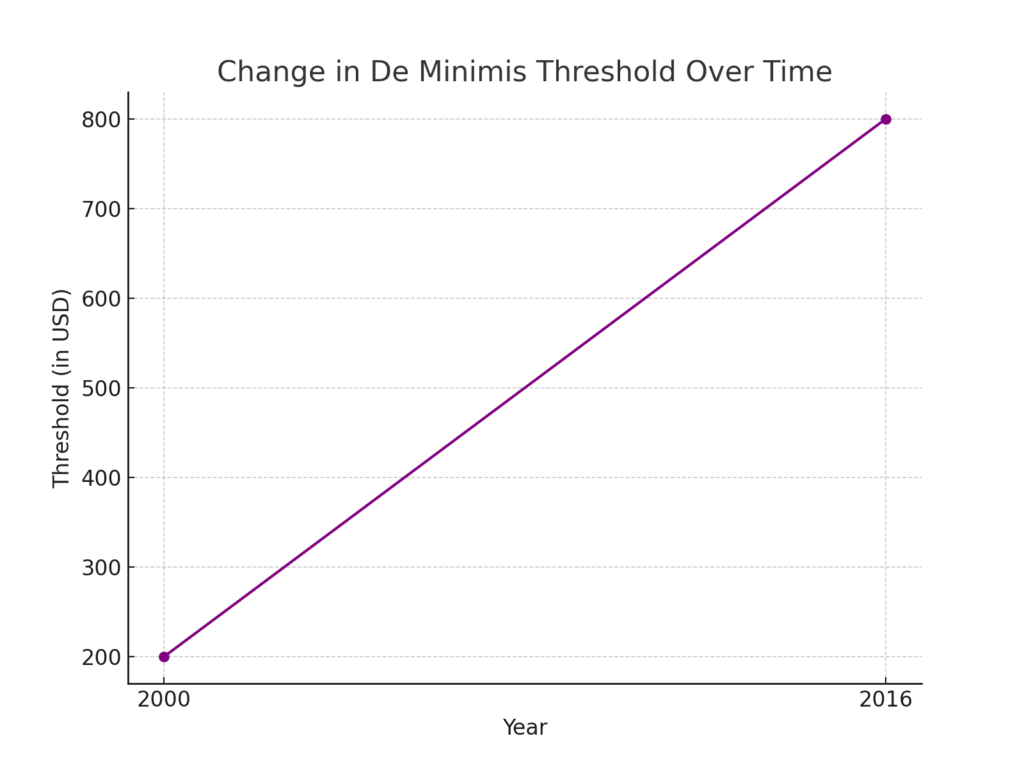

Yes, personal goods valued under $800 are typically exempt under the “De Minimis” rule. This exemption covers most travelers and online shoppers and was raised from $200 in 2016 to streamline small-value imports.

Can the calculator account for different product categories?

Yes, calculators rely on Harmonized Tariff Schedule (HTS) codes, which the U.S. has approximately 19,000 of. Accurate product classification can mean the difference between paying no duty (e.g., computers) versus paying 4-6% (e.g., footwear).

Does the calculator include state taxes or only federal duties?

The calculator typically covers federal duties only, not state taxes. For example, states like California may add additional use taxes for certain imports valued over $800.

What is the “De Minimis” rule, and how does it affect duty calculations?

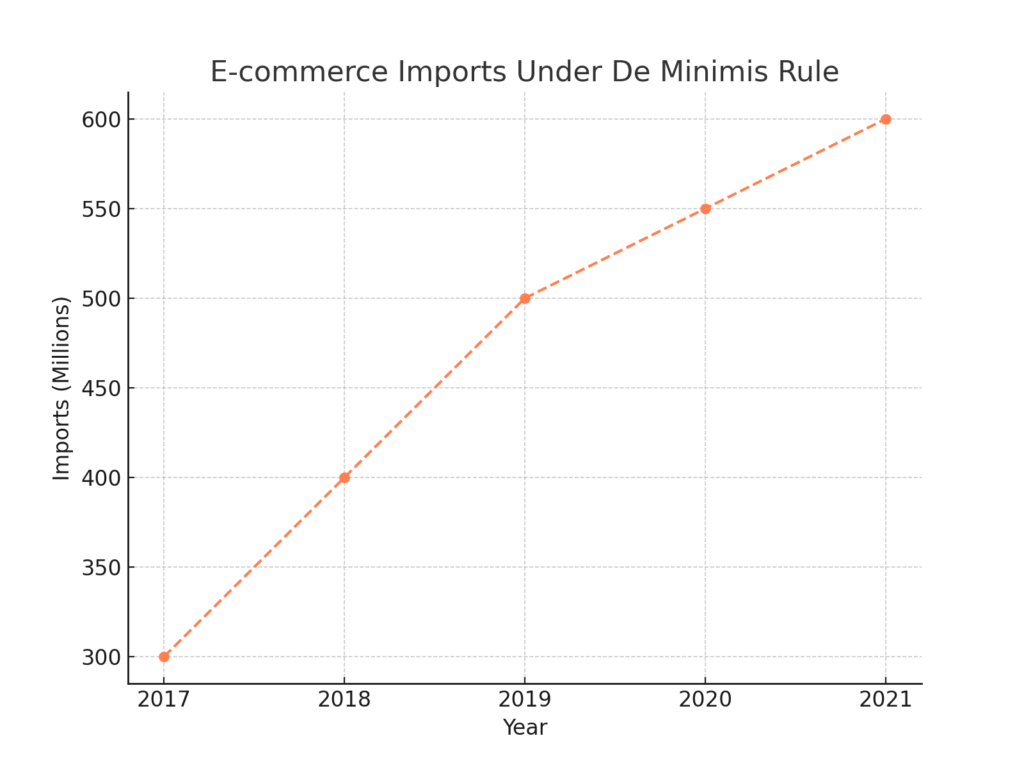

The De Minimis rule exempts imports valued under $800 from duties and taxes. This exemption has led to an increase in e-commerce, with nearly 600 million packages entering under this rule annually.

Are there additional fees besides customs duty?

Besides duty, imports can incur fees like the Merchandise Processing Fee (MPF), which ranges from $2 to $528 for commercial entries, and the Harbor Maintenance Fee (HMF) of 0.125% on ocean freight.

Does the calculator account for Free Trade Agreements (FTAs)?

Yes, if your product is from an FTA country, duties may be reduced or eliminated. For example, under the USMCA, over 99% of goods between the U.S., Mexico, and Canada are duty-free.

How accurate is the U.S. Customs Duty Calculator?

The calculator is generally accurate but provides estimates only. Customs reserves the right to reclassify goods, and factors like product misclassification or undeclared costs can impact the final duty.