Importing goods to Japan can involve various taxes and duties. This Japan import duty calculator simplifies the process by helping you estimate your products’ total import duty and VAT (consumer tax). Whether you’re bringing in electronics, clothing, or other items, this tool provides accurate calculations to help you budget for customs fees.

Service: Get a custom import duty calculations with report. Fill the form here with your import details.

Japan Import Duty Calculator

Calculate the total import duty, VAT, and taxes for your imported goods to Japan. Start by entering the details below. Find rates here!

Disclaimer:

This Japan Import Duty Calculator provides estimates for informational purposes only. Actual duties and taxes may vary based on specific customs regulations, product classifications, and other factors. Please consult with Japan Customs or a professional customs broker for precise details. for more details, check here and here.

Table of Contents

Detailed Overview of Japan’s Import Duty Rates

Understanding Japan’s import duty rates is essential for businesses and individuals engaging in international trade. Here’s a breakdown based on Japan Customs’ regulations:

Key Components of Japan’s Import Duty System

1. Applicable Taxes on Imported Goods

- Customs Duty: Levied on the dutiable value of imported goods.

- Consumption Tax: Applied at rates of:

- 10% (standard rate).

- 8% (reduced rate, applicable to certain goods).

- Other Internal Taxes:

- Liquor Tax: For alcoholic beverages.

- Tobacco Tax: For tobacco products.

- Petroleum and LPG Excise Taxes: For specific energy products.

2. Tariff (Duty) Rates for Commercial Goods

Types of Rates

- General Rate: The Customs Tariff Law defines the default rate and remains unchanged unless amended.

- Temporary Rate: Applicable to specific goods for a limited period and may be higher or lower than the General Rate, as defined in the Temporary Tariff Measures Law.

- WTO Rate: Agreed upon under the WTO and applies to goods from countries with bilateral or multilateral agreements granting most favored nation (MFN) status.

- EPA Rate: Established under Economic Partnership Agreements (EPAs) with countries like Singapore, Mexico, and Malaysia, and applies to goods originating from these countries when rates are lower than the WTO or General Rate.

- Preferential Rate (GSP): Reserved for goods from designated developing countries and lower than the General, Temporary, or WTO rates.

Calculation of Duties

- Ad Valorem Rates: A percentage of the dutiable value of goods (e.g., many electronics are taxed this way).

- Specific Rates: A fixed charge per quantity (e.g., per liter or kilogram), such as certain alcoholic beverages and cereals.

- Compound Rates: A combination of ad valorem and specific rates.

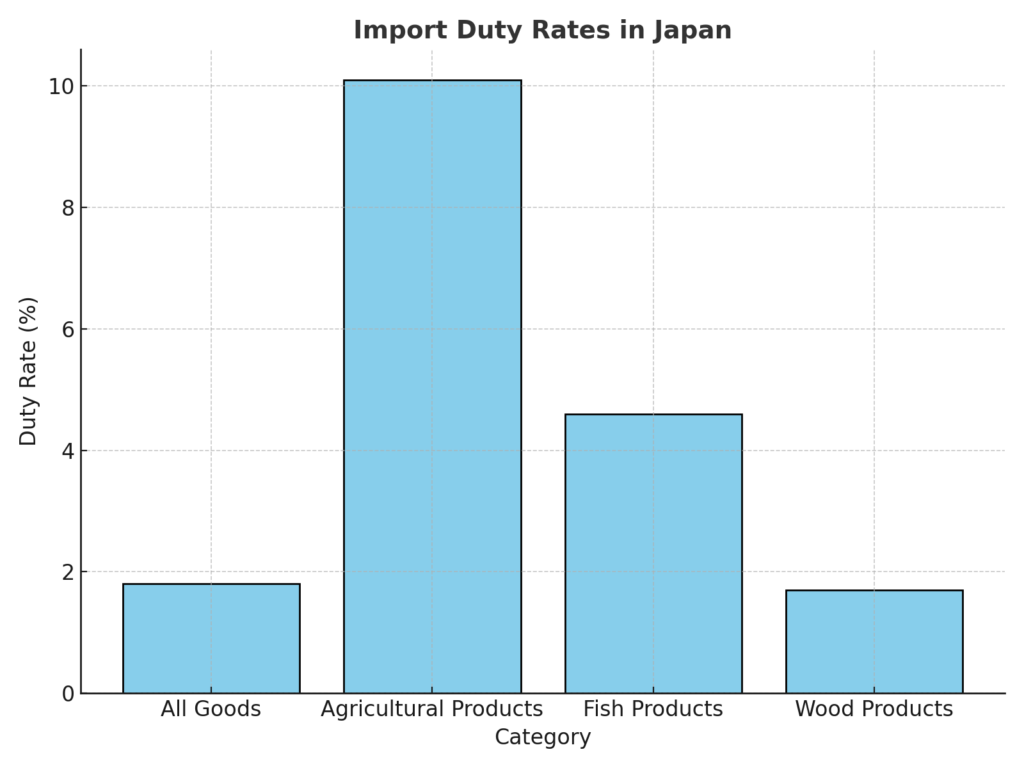

Average Duty Rates (2007 Data)

- All goods: 1.8%.

- Agricultural products: 10.1%.

- Fish and fish products: 4.6%.

- Wood, pulp, paper, and furniture: 1.7%.

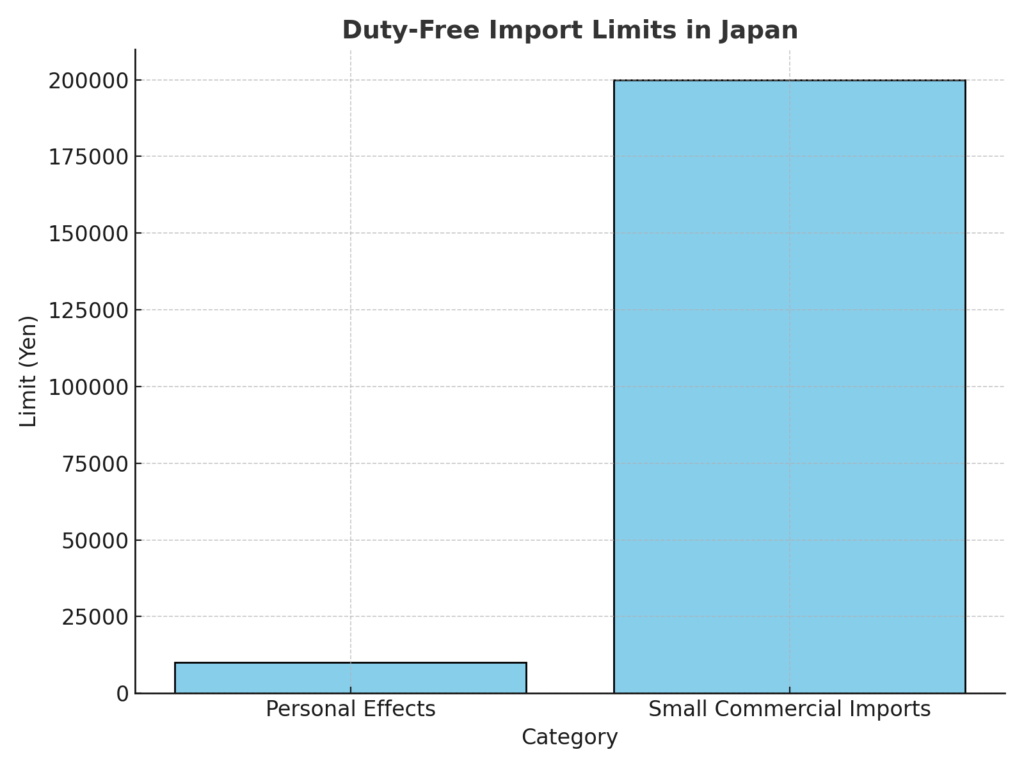

3. Simplified Tariff Systems

For Personal Effects

- Simplified classification schedules reduce complexity for personal imports and include combined duty and tax rates for various goods.

For Small Packages

- Applicable to imports with a total customs value of 200,000 yen or less.

- The simplified tariff schedule includes:

- Alcoholic beverages:

- Wine: 70 yen/liter.

- Distilled beverages: 20 yen/liter.

- Sake: 30 yen/liter.

- Foods and beverages:

- Tomato ketchup, ice cream: 20%.

- Coffee, tea: 15%.

- Vegetables, fruits, seaweed: 10%.

- Non-food goods:

- Tableware, furniture, and toys: 3%.

- Rubber, paper: Free.

- Other goods: 5%.

4. Advance Classification Ruling System

Overview

- Provides importers with a tariff classification before declaring imports to streamline customs procedures, aiding in cost estimates and planning.

Application Procedure

- Formal inquiries yield written rulings, valid for three years.

- Informal inquiries are addressed orally or via email but aren’t binding during customs inspections.

- The validity of a ruling may lapse due to:

- Expired validity.

- Legal or regulatory amendments.

5. Additional Information Sources

Customs Tariff Schedules

- Detailed tariff schedules are available through the Japan Tariff Association.

FAQs

What is the import duty rate in Japan?

The import duty rate in Japan varies depending on the type of goods and their origin.

- Average rates:

- All goods: 1.8%.

- Agricultural products: 10.1%.

- Fish and fish products: 4.6%.

- Wood, pulp, paper, and furniture: 1.7%.

- Simplified tariff rates for small packages (value ≤ 200,000 yen):

- Alcoholic beverages: 20–70 yen/liter.

- Foods (e.g., tomato ketchup, ice cream): 20%.

- Non-food goods (e.g., toys, tableware): 3%.

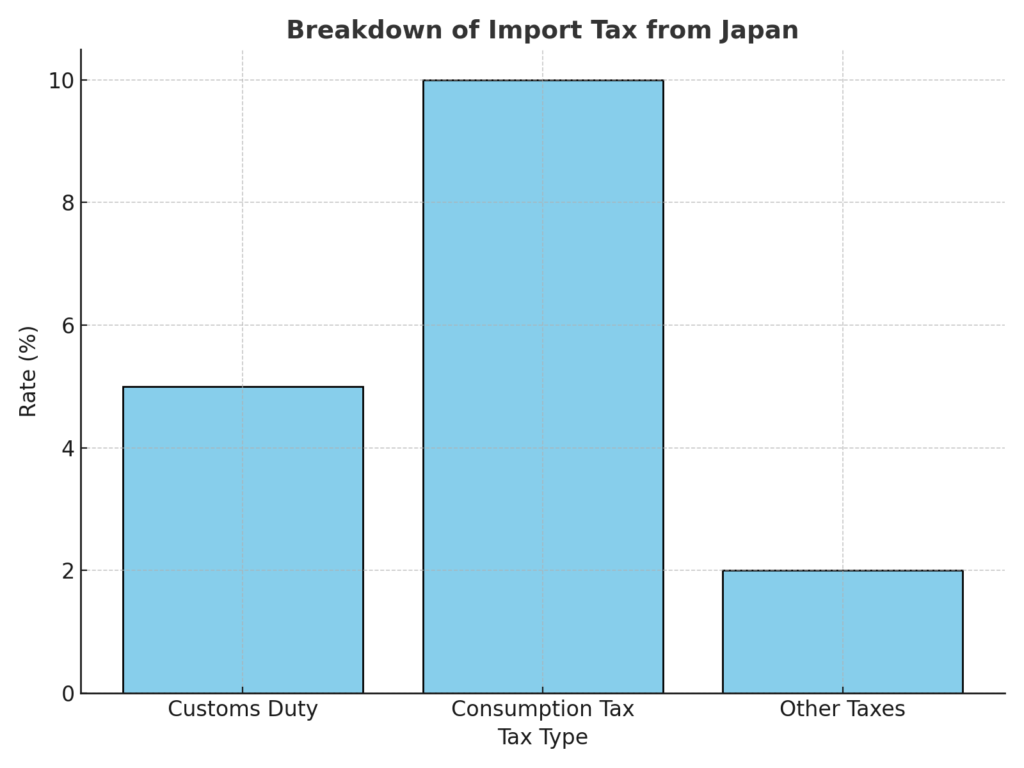

How much import tax will I pay from Japan?

The import tax includes:

Customs Duty: Based on the type and value of goods.

Consumption Tax:

- Standard rate: 10%.

- Reduced rate: 8% (applies to certain items like food).

Other Taxes: May apply to goods like liquor, tobacco, or petroleum.

- The consumption tax is calculated on the value of goods plus customs duty and other applicable taxes.

How to pay import duties in Japan?

At the time of customs clearance:

- Duties are paid before goods are released by Japan Customs.

Payment methods:

- Direct bank transfer.

- Cash or credit card payments at customs offices.

Customs brokers: If you use a broker, they will handle the payment process on your behalf.

How much can I import without paying duty in Japan?

- For personal effects and gifts, you can import items duty-free up to 10,000 yen per item.

- For small commercial imports, simplified tariff rates apply if the total customs value does not exceed 200,000 yen per shipment.

How to calculate import costs from Japan?

To calculate import costs, include:

- Customs Duty: Based on the value of goods and duty rate.

- Consumption Tax:

- (Customs value + Customs Duty) x 10%.

- Other Applicable Taxes: Excise duties for items like liquor or tobacco.

- Shipping and insurance costs (if applicable): These are added to the customs value for taxation purposes.

What is the sales tax in Japan for foreigners?

- The sales tax (consumption tax) in Japan is 10%.

- For tourists, tax exemptions are available on purchases over 5,000 yen (before tax) at designated stores. You must show your passport at the time of purchase.

Tools:

- Canada Import Duty Calculator

- Uk Import Duty Calculator

- US Customs Duty Calculator

- Import Duty Calculator Pakistan

- Iceland Import Tax Calculator

- Indian customs import duty calculator

- Ireland Import Duty Calculator

- Import Duty Calculator for Australia

- Kenya Electronics Import Duty Calculator

- Jamaica Import Duty Calculator

- Kenya import duty calculator

- Nigeria Car custom duty calculator

- Nigeria custom duty calculator

- South Africa Import Duty Calculator

- Tanzania Import Duty Calculator

- Car import duty calculator Bangladesh

- Bangladesh Import Duty Calculator

- Pakistan Car Import Duty Calculator

Browse Import Duty Rates By Country:

- UK Customs Duty Rates

- US Customs Duty Rates

- Canada Customs Duty Rates

- Jamaica Custom Duty Rates

- Ireland Import Tariff Rates

- Import Duty Rates in Bangladesh

- Tanzania Duty Rates

- India Duty Rates

- Nigeria Car Custom Duty Rates

- Kenya Customs Duty Rates

- Japan Customs Duty Rates

- Morocco Import Duty Rates

- Australia Import Duty Rates

- Kenya Custom Duty Rates

Conclusion

Japan’s import duty system is structured to balance trade facilitation with revenue generation. Businesses and individuals importing goods should familiarize themselves with applicable rates, classifications, and simplified systems to ensure compliance and optimize costs.